How a unified payments platform restores control and combats the dangers of fragmented systems

Campuses function like small cities, with countless departments, clubs, and organizations collecting payments for everything from event tickets to meals. According to Michael Wilson, Director of Sales at TouchNet, this complexity often leads to what he calls rogue payment points. Rogues are payment systems adopted outside of institutional oversight, and they can spell big problems for the institution.

When a campus group, club, or department takes payments in ways outside the normal institutional processes, this decreases transparency, increases the potential for fraud or mishandling of funds, and a creates a lot of work for campus treasurers.

Student clubs, for example, may use personal card readers or consumer-grade payment apps without understanding institutional requirements.

In a recent blog, Wilson says these payment points typically emerge unintentionally, as groups seek the fastest and easiest way to accept payments. However, he cautions that following the assumed path of least resistance can cost institutions in other ways, especially when convenience outweighs security, compliance, and visibility.

Wilson outlines several risks created by decentralized payment activity, starting with a lack of transparency. Student clubs, for example, may use personal card readers or consumer-grade payment apps without understanding institutional requirements. Multiply that behavior across dozens or hundreds of campus groups, and institutions quickly lose visibility into how funds are collected, stored, and transferred.

This lack of oversight also increases the risk of fraud or mishandled funds. Without standardized controls, bad actors can exploit weak points in the system, while even well-meaning staff can make costly errors.

Even a small percentage of transactions handled outside centralized systems can disproportionately increase workload and costs.

Compliance is another major concern. Rogue payment points make it difficult for institutions to meet local, state, federal, and PCI requirements. He advises campuses to inventory of payment devices, routinely inspect them, and document incident response plans.

Beyond risk, rogue payment points also create significant administrative burden. Each unique merchant setup requires its own reconciliation process, increasing labor and complexity for finance teams. Even a small percentage of transactions handled outside centralized systems can disproportionately increase workload and costs. High transaction fees from standalone payment providers further erode institutional budgets.

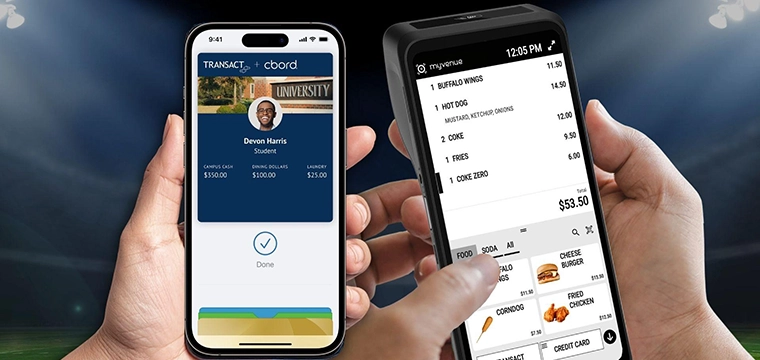

To combat rogue payment points, he advocates for a unified approach. “One of the best ways you can avoid the pitfalls associated with rogue payment points is to implement a unified payments platform that can work for campus organizations and merchants alike,” he writes. Centralized platforms reduce fees, streamline reconciliation, and provide consistent security and compliance across campus.

To read more, check out the full article here.