Max Steinhardt, COO for campus card provider CBORD, has been named the company’s new president effective May 1. He succeeds Tim Tighe, who has served as a CBORD executive for more than 25 years.

“At CBORD we have planned for this transition,” said Tighe. “CBORD will keep front and center our tradition of excellent customer service and an active customer voice in product innovation. Max is fully engaged with our customers. He’s demonstrated steady focus on quality of service and customer satisfaction. I am confident that CBORD is in great hands.”

Since joining the company in 2006, Steinhardt has served as the senior vice president of operations and more recently as chief operating officer.

“The CBORD team is a terrific group of dedicated and accomplished professionals,” said Steinhardt. “It’s an honor to become their president. The company is in great shape, with enviable products, a world-class customer base, and a powerful culture that puts the customer first.”

He added that CBORD “is gaining momentum in its markets and has added important new international areas of expansion. As our team looks at this internal transition, we’re very aware of the leadership strength that has guided the company. We are aware of the vision our leadership has shared. My priority will be to carry that vision forward as we build a successful future at CBORD.”

The CBORD Group provides campus cashless and security solutions and foodservice and nutrition management software and related services.

UK printer manufacturer Magicard has upgraded one of its ID card printers, now called Enduro+. The redesign includes fraud proof ID card printing technology which helps to reduce costs and make card printing quicker and more secure.

The printer is good for schools, colleges and medium sized businesses that print up to 10,000 cards a year.

Other new features include:

Ethernet connectivity to enable remote printing from any office;

Improved color mapping for better photo clarity;

Multiple encoding options;

Rewrite technology;

Easily ungradable from single to double sided printing;

Secure watermarking with Magicard’s HoloKote feature.

The original Enduro printer was launched in 2008 and is Magicard’s most popular card printing machine with tens of thousands installed worldwide.

Banking partnerships increase in 2011, though slightly

Campus card bank partnerships, like many financial service offerings, are having a tough time as increased regulation makes it harder for banks to turn a profit and make programs attractive to schools. Despite this challenge, 2011 saw some growth in the number of programs and several banks did see their numbers increase.

The biggest issue for banks with campus partnerships is how to make money. As regulators clamp down on fees banks can charge cardholders and merchants, the profitability matrix has changed. The pendulum has shifted forcing banks to focus less on fee income to make the business case and more on the long-term value of the customer relationship.

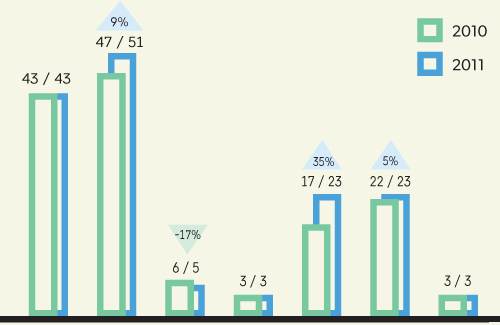

## Campus Card Bank Partnerships: 2010 - 2011 Comparison

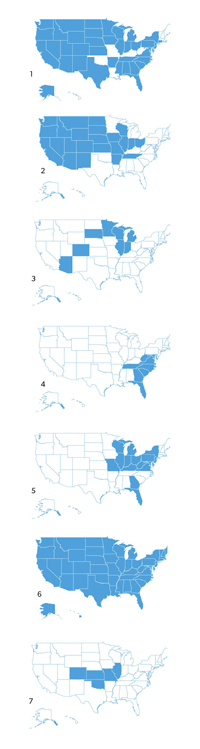

From left to right: 1. Wells Fargo 2. U.S. Bank 3. TCF 4. SunTrust 5. PNC Bank 6. Heartland 7. Commerce

## What have new regulations done for banks?

New regulations are playing a role in a bank’s ability to do business, and they will likely have an even larger impact in 2012 and beyond.

The biggest change is the Durbin Amendment, named after Sen. Richard Durbin (D-Ill.). The rule was an amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

In effect since October 2011, Durbin caps the interchange and transaction fees banks can charge merchants to accept debit cards. Banks were charging up to 44 cents per transaction but the amendment slashes that nearly in half, to 21 cents plus 0.05% of the transaction (2 cents average). Issuers can charge an additional penny if they have approved fraud-prevention standards in place.

Durbin fee restrictions only impact banks with more than $10 billion in assets, banks considered large under the regulation. Smaller banks with assets less than $10 billion can continue to charge merchants at pre-Durbin rates.

“Banking regulations have affected the financial model previously used by many banks for campus cards,” says Bill Norwood, Heartland Campus Solutions’ chief architect. “The Durbin rule hit the large banks hard reducing interchange revenues significantly,” he says.

Heartland offers banking services through its partner Central National Bank (CNB), Enid, Okla., which falls below the Durbin asset cap making it exempt from fee limits.

How important is fee income to an institution’s desire to pursue campus card partnerships? “It’s important to any financial service provider trying to work with campus card programs,” says Norwood.

The new regulations, coupled with a down economy, are causing both banks and campuses to postpone expansion.

“The Durbin Amendment greatly reduced our revenue from debit cards and that makes investment in new campus partnerships and new card technology more difficult,” comments Don Becker, assistant vice president, student banking and university cards at Commerce Bank.

Norwood agrees. “The tough economic times have forced campuses to examine why they are implementing or expanding their card programs and if the expansion or implementation requires sizeable capital investments, some schools have elected to push back in hopes the economy improves,” he says.

In addition, reduced profitability has led banks to tighten up on revenue share to campuses, making conditions ripe for a stalled market.

According to Whitney Bright, vice president, general manager of campus banking for U.S. Bank, new regulations have certainly made the campus banking environment more challenging, but this has not deterred the institution’s interest in such programs. “We continue to aggressively pursue new partnerships that are beneficial for the students, the campus and U.S. Bank,” she says.

PNC, which has seen an increase in campus clients, has seen renewed interest in campus cards from schools. “We have seen an up tic in the level of interest by universities and colleges for retail banking services programs, including ID features,” says Nickolas Certo, senior vice president of university banking for PNC Bank.

Christina Castro, TCF’s vice president and region manager, says new regulations haven’t impacted the pace of new campus card and banking partnerships for TCF. Fee income is only one factor in a campus banking partnership.

## Growth in campus banking partnerships

While finding it more difficult to turn a profit, banks are still plowing ahead with new campus partnerships. According to CR80News’ 2011 bank partner survey, overall campus growth in 2011 among the seven banks surveyed was 8%. There were 152 campus clients reported in 2011 by the seven banks compared with 141 the previous year. That 8% growth rate is double the 2010 growth of 4%, but it still falls far short of the 20% growth in both 2008 and 2009.

Four of those seven banks–Heartland/CNB, PNC Bank, U.S. Bank and Wells Fargo–account for 93% or 141, of the 152 colleges being served. (Note: only relationships that integrate the official university-issued ID card as a banking card are considered for the survey.)

U.S. Bank is still leader of the pack in terms of number of campuses served. It grew by four schools and now handles 51 campuses. That’s a 9% increase over its 2010 figures. The other bank that represents a hefty number of schools is Wells Fargo, which serves 43. That’s the same number the bank served in 2010. Still that doesn’t mean the bank didn’t garner new clients. It just lost a few as well.

Pittsburgh-based PNC Bank added seven to its campus total. The bank now serves 24 campuses, compared with 17 in 2010.

Heartland/CNB added one to its roster, growing from 22 to 23 schools. Both Commerce Bank and SunTrust held steady each serving three schools. TCF Bank lost one client in 2011 and now stands at five schools.

Wells Fargo’s banking footprint covers 39 states while U.S. Bank serves campus card clients in 25 states. PNC can now serve campuses in 16 states, a sizeable jump from the seven states reported in 2010.

Much of this increase can be attributed to PNC’s acquisition of National City Bank in 2008. PNC spent two years integrating those banks into its network, which added six states. PNC also added branches in New York and bought branches from Flagstar Bank, bringing PNC’s footprint up to its current 16 states. PNC is also in the process of acquiring the U.S. banking assets of Royal Bank of Canada. The sale is expected to be final in March 2012, which would add three more states.

TCF, Commerce and SunTrust have far smaller footprints ranging from five to eight states.

Changing to suit the market is important in the campus space and sometimes that means budget cuts, says Norwood. “Between budget cuts and reduced campus staff, all are looking for ways to do more with less,” he adds.

Tough times can bring positive results. In the case of banking services for campus cardholders, 2011 may result in more competitive offerings and a renewed focus on client service.

“The ability to competitively price banking products and services remains a key factor in our bank’s long-term success with campus partnerships,” Becker says. “Young consumers look for value in the marketplace and I believe banks who can deliver that value in convenient and innovative ways will continue to see success on campus.”

In addition to remaining price competitive, customer service and satisfaction is crucial for banks to retain student clients as they mature into profitable lifelong clients.

With shrinking revenue from fees PNC has adapted its strategy for the campus market, Certo says. “The key driver of a successful banking program is the generation of new customers. Individual retail bank customer profitability has been impacted across the board by regulatory changes and the prevailing interest rate environment,” he explains. “In the face of these changes PNC Bank has taken steps to manage its costs and the way we go to market at universities and colleges.”

Commerce (3)

Fort Hays State University, KS

Pittsburg State University, KS

The University of Kansas, KS

Heartland (23)

Bastyr University, WA

Clearwater Christian College, FL

College of the Holy Cross, MA

Colorado Christian University, CO

Concordia University of Wisconsin, WI

Harrisburg University, PA

Hillsborough Community College, FL

Florida Coastal School of Law, FL

John Carroll University, OH

Lebanon Valley College, PA

Manhattan College, NY

Mississippi Delta Community College, MS

Mount Holyoke College, MA

North Central Missouri College, MO

Northwest Florida State College, FL

Palm Beach Atlantic University, FL

Pittsburgh Technical Institute, PA

Reinhardt College, GA

Slippery Rock University, PA

St. Thomas Acquinas, NY

Tompkins Cortland Community College, NY

University of Massachusetts Lowell, MA

Waukesha County Technical College, Wa

TCF Bank (5)

Northern Illinois University, IL

St. Cloud State University, MN

University of Illinois, IL

University of Michigan, MI

University of Minnesota, MN

U.S. Bank (51)

Austin Peay State University, TN

Benedictine University, IL

Bethel University, MN

California State University, CA

California State University, CA

Capital University, OH

Carroll University, WI

Central Washington University, WA

College of Mt. St. Joseph, OH

Colorado State University, CO

Concordia University Chicago, IL

Creighton University, NE

Drury University, MO

Gonzaga University, WA

Hamline University, MN

Harris-Stowe State University, MO

Henderson State University, AR

Iowa State University, IA

John Carroll University, OH

Johnson County Community College, KS

Kirkwood Community College, IA

Metropolitan State College of Denver, CO

Milwaukee Area Technical College, WI

Minnesota State University Moorhead, MN

Missouri Baptist University, MO

Missouri Western State University, MO

Morehead State University, KY

Normandale Community College, MN

North Dakota State University, ND

Northern Kentucky University, KY

Northwest Missouri State University, MO

Northwestern University, IL

Pacific University, OR

Saint Louis University, MO

San Diego State University, CA

San Jose State University, CA

Seattle University, WA

Southwest Minnesota State University, MN

St. Cloud Technical & Community College, MN

Thomas More College, KY

Truman State University, MO

University of California Davis, CA

University of Central Missouri, MO

University of Missouri Kansas City, MO

University of San Diego, CA

University of Wisconsin-Eau Claire, WI

University of Wisconsin-Stevens Point, WI

Washington State University, WA

Waukesha County Technical College, WI

Wisconsin Lutheran College, WI

Xavier University, OH

Wells Fargo (43)

Baylor University TXCalifornia State University-East Bay, CA

California State University-Los Angeles, CA

California State University-Sacramento, CA

California State University-San Francisco, CA

California State University-Stanislaus, CA

Colorado Mesa University, CO (formerly Mesa State University)

Clark Atlanta University, GA

El Paso Community College, TX

Elon University, NC

Fayetteville State University, NC

Florida A&M University, FL

Florida International University, FL (new)

Front Range Community College, CO

Georgia Perimeter College, GA

Guilford College, NC

Mercer University, GA

Midwestern State University, TX

Minnesota State University-Mankato, MN

New Mexico State University, NM

North Carolina State University, NC

North Carolina A&T State University, NC

North Carolina Central University, NC

Northern Michigan University, MI

Riverside Community College District, CA

Texas A&M University-College Station, TX

Texas A&M University-Corpus Christi, TX

Texas State University-San Marcos, TX

University of Arizona, AZ

University of Florida, FL

University of Nebraska-Kearney, NE

University of Nebraska-Lincoln, NE

University of Nevada-Las Vegas, NV

University of Nevada-Reno, NV

University of North Carolina-Chapel Hill, NC

University of North Carolina-Greensboro, NC

University of North Texas, TX

University of Northern Colorado, CO

University of Texas-Arlington, TX

University of Texas-Dallas, TX

University of Texas-El Paso, TX

Villanova University, VA

Virginia Commonwealth University, VA

PNC Bank (23)

List not provided at request of institution.

Quantity verified as accurate by editorial staff.

SunTrust (3)

Florida State University, FL

Mary Baldwin College, VA

University of Central Florida, FL

Heartland Payment Systems has launched the latest version of its WaveRider Laundry System, a wireless payments and account management solution that gives laundry service providers a secure method of accepting credit and debit card payments.

Similar to a card reader at a gas pump, WaveRider card readers attach to washing machines and dryers, providing a secure payment process for consumers using any major credit or debit card. WaveRider not only eliminates coins and reliance on closed-loop laundry cards, it removes cash collection procedures for laundry service providers.

Incorporating Payment Card Industry compliance standards that protect payment card data, the newest version of WaveRider adds a series of enhancements for both service providers and consumers. Providers now have online Test-Vend card management tools that allow technicians to start laundry machines for troubleshooting and problem diagnosis. Providers can also track card usage and add or delete cards as necessary. Additionally, providers can perform remote software updates, eliminating the need to visit laundry rooms to install new features.

For consumers, WaveRider is optimized for mobile devices, providing smart phone functionality that enables users to view the status of washers and dryers before visiting a laundry facility. It also lets them receive text alerts when their laundry cycles are complete. For college students using Heartland’s Campus OneCard system, WaveRider also accepts OneCard transactions.

WaveRider streamlines workflow for laundry operators, allowing them to remotely manage multiple facilities through a secure Web-based account management portal. Laundry operators can review revenue generated at a property and adjust or change prices. They can also minimize downtime and potential loss of revenue by receiving real-time alerts the moment a machine breaks down. The system also supports coin and card operation on the same machine.

“We’re seeing a tremendous interest in WaveRider because consumers want to use their debit or credit cards to pay for common purchases such as laundry, and laundry service providers need to reduce the amount of driving to collect quarters from machines, especially with gas at nearly $4 per gallon,” said Ron Farmer, executive director of campus solutions and micropayments for Heartland.

If you want to use a credit card to pay your tuition at Drake University, Des Moines, Iowa, be prepared to pay more. In addition to the 4.11% tuition hike, which recently went into effect, students will now have to pay an extra 2.75% surcharge if they use a credit card.

With a tight economy and budget cutbacks, it’s another way colleges and universities are looking for ways to save money. In the past, the university absorbed the annual $250,000 cost for allowing students to use cards, but President David Maxwell said the university can’t afford that anymore.

“It’s part of the operating budget, and this is passed on to all students in the form of tuition,” he said. “By doing this, it will be the people who choose to pay with a credit card who are paying the charge, not everyone else.”

But some students aren’t too happy with the plan.

“A 2.7% fee is ridiculous, especially if it’s like $1,000 for your tuition,” commented one student.

Obviously, the surcharge is forcing most students to switch how they pay, either with a check or debit card.

According to the Times-Delphic, Drake’s student newspaper, the National Association of College and University Business Officers said that 28.7% of payments to universities and colleges are via credit card. At small institutions such as Drake, 24.3% of payments are made through credit cards.

Read more here.

The CBORD Group rolled out GET Funds, an online and mobile commerce software application that puts account information in the hands of students wherever mobile smart phone services are available.

GET Funds gives students 24/7 account access utilizing a mobile phone or computer. Students can instantly look up account balances and transaction histories, make or request account deposits, report campus cards lost or found, view locations that accept the campus card for payment, and more.

Students can also deposit money into their own accounts or instantly send messages to parents requesting funds. Parents then make online deposits to the specified accounts.

GET Funds integrates with CBORD’s CS Gold, Odyssey PCS and OdysseyOne campus card systems, making it easy to manage existing accounts without complicated interfaces or conversions.

“The mission of GET Funds is to provide the ultimate in convenience and value in students’ day-to-day lives,” says Cindy McCall, CBORD’s marketing vice president. “Colleges and universities are looking for ways to provide quality services to a new generation of students. CBORD listened to the users and responded with a solution that meets the needs of today’s students.”

Be it Android, Apple, tablet or smart phone … mobile devices are everywhere, and users want to do everything on them that they do on their desktop. As the functionality increases so do the threats to the information stored on and accessed by the devices. The same dangers that plague the desktop world are exacerbated in the mobile world.

Mobile brings convenience, access and portability with a low cost of entry, but it creates a “perfect storm” of risk, explains Juan Duque, principal in the Federal Enterprise Technology Risk Services at Deloitte. “It can be the same risk you see in the non-mobile environment but it can go even deeper,” he says. “The risk universe is expanded.” some aspect of near field communication for identity. The U.S. government is looking at how the communications protocol can be used in connection with PIV and PIV-I credentials, and the enterprise sees it as a solution for converged physical and logical access control.

The challenges with mobile devices and identity are numerous, and after years of discussion, industry finds itself in the midst of a great experiment. Significant issues surround the policies that govern these devices and credentials. Existing policy needs to be changed or created from scratch to deal with challenges the mobile devices presents to an enterprise.

On the technology side many feel it is a foregone conclusion that the mobile will use some aspect of near field communication for identity. The U.S. government is looking at how the communications protocol can be used in connection with PIV and PIV-I credentials, and the enterprise sees it as a solution for converged physical and logical access control.

One of the core issues with credentials on the mobile is where to store it on the device and who controls that area. For followers of near field communication, these issues will sound very familiar.

“Who controls the secure element? Who owns the secure element? What form does it come in?” asks Terry Gold, vice president of U.S. sales at idonDemand.

These questions have plagued the NFC market and delayed adoption as ecosystem players have struggled for control. On the payment and marketing side, there has been some compromise with carriers, financial institutions and handset manufacturers partnering to rollout initial services.

But on the identity and credentialing side it’s not yet clear how this will work and who will control and profit from mobile identity. “You have this big battle shaping up,” Gold says. “If you have a secure element who is going to own and control it? It is not really owned by the end user. Even though he decides what apps and identity elements go on his handset, it’s someone else who provides the security.”

Eventually the secure element will have to be owned by the end user and access granted to any application he sees fit, Gold says.

There are three options for storing identity credentials on a mobile device’s secure element. One would place it on the SIM, a smart card in the handset that is used for identification to the mobile network. This choice is handset agnostic and the mobile operators–such as AT&T, Sprint, Verizon, T-Mobile–control the SIM.

Placing the credential on a microSD card that is inserted into the phone is another option. Many smart phones–Android, Blackberry but not the iPhone–have microSD slots and the credentials could be removed and placed in other handsets if an individual switched devices. In this case the issuer of the microSD card would be its likely owner.

The final option is embedding the secure element into the handset. The handset manufacturer would own this space, and many are already adding this capability to devices. Notably, RIM is going this route with its Blackberry handsets.

To further cloud the issue, it’s also possible that handsets could have more than one secure element, or even all three types, with different owners for each. “Everyone wants control of the secure element in NFC,” Gold says. “On the identity side it gets difficult. If someone else owns that secure element how are you going to put an identity credential on it?”

Will the secure element owner charge a fee to put a credential on the device? Will companies or organizations be willing to pay? Questions abound.

The handset as access control card

HID Global has seen these issues arise and is designing a solution that will work in any environment and can manage the credential wherever it is stored, says Karl Weintz, vice president of business development for the mobile access business at HID.

A pilot in the fall of 2011 at Arizona State University had HID Global showing how its solution can work with different handsets. The 32 participants were outfitted with one of three devices: RIM’s BlackBerry Bold 9650, Samsung’s Android (multiple models) or Apple’s iPhone 4G.

The pilot relied on microSD cards and sleeves for the NFC functionality because handsets that include NFC in the U.S. are not widely available. Three separate carriers–AT&T, Verizon and T-Mobile–were used for mobile services and the credentials were manually loaded on to the handsets.

HID’s solution will be handset and carrier agnostic. Because of the small size of the pilot and the control the school and vendors exerted over the pilot it was able to avoid some of the issues that may crop up during a full-scale rollout of placing the credential on the device.

That said the program was still successful. Approximately 80% of the ASU participants reported that using a smart phone to unlock a door is just as convenient as using their campus ID card. Nearly 90% said they would like to use their smart phone to open all doors on campus.

And, while the pilot was focused on physical access, nearly all participants also expressed an interest in using their smart phone for other campus applications including access to the student recreation center, as well as transit fare payment and meal, ticket and merchandise purchases.

HID also has a partnership with ISIS–the consortium of AT&T, Verizon and T-Mobile that will rollout NFC in 2012. This project will place the credential on the SIM, Weintz explains.

Having the choice to add applications and functionality to a device is important and may be critical in successful deployments of NFC. Neville Pattinson, vice president for Government Affairs, Standards and Business Development at Gemalto, says the mobile is going to impact three markets – payments, transit and identity – and it should be up to the device owner as to which applications they choose.

Arizona State University, Tempe, and the state’s largest privately-held bank have partnered to implement a MasterCard student ID for students and faculty. Labeled the Pitchfork ID after the school’s nickname, the Sun Devils, the MasterCard is intended to function as a check card and student ID, enabling access to dorms, recreation centers and meal plans.

The switch to the new card, backed by MidFirst Bank, comes as ASU announced on its Web site that the Sun Dollars program designed for off campus use will soon be extinct. The new check card will take its place.

Students and faculty can still opt out of the MasterCard plan and receive a regular Sun Card that functions as an ID, carries meal plans and allows building access, but they would not be able to use Sun Cards for campus vending machines, health services or parking services. Instead, students will have to pay for those with a Pitchfork Card or other form of payment.

The check card will be directly tied to students’ free Sun Devil Checking Account with MidFirst Bank which students can begin signing up for now.

Read more here.

Initial pilot success leads to multi-country demonstration phase

Despite what appears to be a snail’s pace, the European Education Connectivity Solution project is still proceeding with its mission to establish a standardized campus card system for the European continent. If successful, students will be able to use the same ID at institutions across Europe.

The project is the brainchild of the European Campus Card Association (ECCA). The group, which represents card programs throughout Europe, conducted a study several years ago to determine if such a project was feasible or for that matter needed. The answer to both questions was yes.

Following the study, the European Education Connectivity Solution project was created in 2009. The plan was to run a two-campus pilot followed by an extended six-campus demonstration project.

The pilot project involved Ireland’s Waterford Institute of Technology and Poland’s Technical University of Lodz, both members of ECCA. The pilot project, which concluded May 31, 2011, cost nearly US$2 million and was funded by the European Union and other contributors including OneCard Solutions, an Ireland-based smart card provider; Mecenat, a Swedish provider of student discount cards; and OPTeam, a system integrator and software developer based in Poland.

The consortium hoped to show that students can study at different universities across the continent without having to physically carry academic records, says Eugene McKenna, chief executive of campus services, Waterford Institute. Instead, the student ID acts as a key for students to access these records wherever they might study.

“We found that there is a large market across Europe for a standardized interoperable campus card system that facilitates student mobility,” says McKenna.

This doesn’t mean that European students like to jump from school to school. Rather, it means that they can utilize various facilities at other universities that may not be available at their home institution, such as a specialized library or sports facility.

A survey of more than 100 European higher education institutions found that 85% would use the standardized campus card solution when it became available, says OneCard’s Kate Kelly. After the demonstration phase is complete it is the goal that any campus can implement the new system, she explains.

“There is a clear requirement in Europe that the campus card should be a means to identify a student from their own campus and facilitate a basic range of services in the campus they are visiting,” says McKenna. “The creation of a standard campus card system is intended to enable colleges to share information using the card as the electronic key so that administrators at other schools can access student records on secure databases.”

After determining the feasibility and the need, the next step was to demonstrate that it was possible using two geographically separate campuses to test the system in a live working environment, says McKenna.

At Waterford, students from Lodz, Poland tested student mobility, library patron ID, Web value loading and vending payments. At Lodz, students from Waterford tested student mobility, library ID and class attendance.

The student connectivity trial enabled the student to logon using the campus card and apply to be an exchange student. The library trial enabled exchange students to access the library services and check out books at their visiting institution using their home campus card. The student details were displayed on screen and the loan transaction was completed.

For class attendance, the Waterford exchange student presented the card to the Lodz attendance card reader, which processed the card and authenticated that the Waterford cardholder was an approved student.

Finally, if the Lodz student arrived in Waterford with no funds on his campus card, all he had to do was log into the Waterford Web Value load site and top up the purse using a credit card, says McKenna.

The consortium was satisfied with the pilot results and is progressing toward the more intense demonstration project phase. This phase will involve six colleges implementing the system and is scheduled to commence in early 2012. “The key purpose of this phase is to bridge the gap between the research and commercialization of the product,” says Kelly. “We have established partnerships with six higher education institutions in six different countries.”

The demonstration project will be supported by OneCard, Mecenat and OPTeam. The Card Technology Research Center in Ireland will also participate and OneCard will again be the project coordinator.

The demonstration phase is expected to cost US$2.5 million and take between 12 and 18 months to complete. Following a successful trial, rollout of the full product is expected in 2013 and 2014.

The demonstration project was originally to have begun in May 2011, but the pilot phase took longer than expected. It took the ECCA more time to create a technical specification that would meet the requirements of all the European campuses, says McKenna. “Bringing (everything) together as an integrated standardized campus card solution is a very challenging task.”

IdentiSys Inc., an Eden Prairie, Minn.-based sales and service integrator of ID cards and access control security systems, has acquired Capital Card Systems Inc., a Rockville, Md. ID reseller. The purchase represents an expansion for IdentiSys into the Washington D.C. and Baltimore metro areas.

Capital Card Systems provides identification technology solutions including digital photo IDs, embossed card personalization, loyalty or membership cards, smart card/biometric applications and patient identification solutions to the corporate, government, health care, education, membership and loyalty, first responder and emergency management markets.

The company now has sales and service offices covering one-third of the U.S. Founded in 1999, IdentiSys offers identification, security and tracking solutions, including most applications using a plastic card, ID badge, metal tag, or biometric.

The company is a member of a number of national associations, including the National Association of Campus Card users.