Programs flourish when multiple campuses share merchant network

Programs flourish when multiple campuses share merchant network

Just a few short years ago, allowing a university’s campus card to be used off campus was a no-no. Fears about losing precious on-campus income to merchants surrounding the campus prevented many universities from taking the step.

But as Jason Tiede, director of Blackboard’s off-campus program, BbOne, says they now have become the norm. “It’s unique if you don’t have one. Besides, students want it. They want the expanded services, such as late night dining, weekend offerings, delivery and gas. It’s not so much they want something that’s physically away from campus, they want those services that a school otherwise couldn’t provide on its own.”

While there’s no hard evidence to show that schools with an off-campus program have a competitive advantage over nearby schools that don’t, it has become a nice selling point for campus card vendors. In addition, a vendor with an already established off-campus program in an area may find it easier to recruit other schools to join.

That’s why off-campus programs are now part of many campus card vendors’ menu of services and other companies are offering programs regardless of which vendor provides the college’s campus card.

Off Campus Solutions (OCS) provides off campus programs for more than 60 campuses, regardless of campus card provider, says Greg Baker, president and chief technology officer at the company.

OCS is a subsidiary of Sodexo Campus Services. Sodexo manages on-campus dining and facilities services at more than 800 colleges and universities. Baker says that OCS supplies off campus programs to institutions with or without a Sodexo partnership though the majority of clients are Sodexo customers.

Schools are going off campus because students want the option and it can bring in revenue to the school, says Baker. Participating merchants like it because they obtain access to funds they may not have had access to in the past.

Campus card provider, CardSmith, serves multiple schools in several areas and the campus cards are all interoperable. As long as the merchant has the point-of-sale terminal and the campus has the CardSmith program in place it will work, explains Brian Farley, CardSmith’s vice president of business development. “So if you’re a Boston merchant and you have a terminal and you’re around the corner from say Berklee College of Music, that single terminal will also accept ID cards from other campuses in the area,” he says.

CardSmith’s best-known multi-school operation is the six-college consortium in Boston called Colleges of the Fenway. It is an ideal example of how one card can be used on campus at multiple institutions as well as at a shared network of off-campus merchants. In addition to the six Fenway schools, CardSmith also serves five other campuses in the Boston area, says Donna Franklin, CardSmith’s vice president marketing and communications.

The Colleges of the Fenway’s card is a shared service program. The interoperability is communicated to students as a service for their convenience, says Franklin. While each school offers a different ID, each will work in a single terminal at the merchant location.

“When we have all those campuses in a given geographic area, it’s easier to sign up other schools,” explains Franklin. “With Campus Cash, each new campus we add automatically has access to our entire off-campus network.”

CardSmith also supports a multi-campus community in Jacksonville, Fla. providing services to the University of North Florida, Jacksonville University and Florida State College of Jacksonville.

It’s obviously more efficient for merchants, campus card providers and the universities to enable merchants to accept multiple cards. “How many acceptance posters can you put up?” asks Franklin. “With Campus Cash, you only need one.”

Executives for both CBORD and Blackboard agree. “Having business relationships already in place between a local campus and merchant community make the conversations with nearby campuses easier,” says BbOne’s Tiede.

CBORD has successfully leveraged the strength of its off campus program to get new schools with a focus on ‘off campus’ to install CBORD’s one card solution, says Shawn McCarthy, CBORD’s vice president for wide area commerce. “We’ve had some good take-aways from competitors,” he adds.

Another plus is having corporate partnerships with national chains like CVS and Chipotle. “We can leverage our relationships with national chains to very quickly bring off campus services to the university community,” says Blackboard’s Tiede.

Both CBORD and Blackboard got into off-campus programs by buying established companies. A wholly owned subsidiary of CBORD is Off Campus Advantage, which was purchased in 2007. “(It) services all CBORD schools for off campus requirements,” says McCarthy. While the company has some 800 schools under its campus card umbrella, just 90 so far use Off Campus Advantage, says McCarthy.

Some of CBORD’s multiple accounts include Boston, Washington, D.C., Texas, California and Minneapolis. “The largest concentration is in the northeast. The largest are the SUNY (State University of New York) schools,” adds McCarthy.

BbOne, Blackboard’s off-campus management solution, came about from the company’s purchase of Student Advantage’s SACash offering in 2003. With that purchase came 24 universities, which jump-started Blackboard’s off-campus program.

There are about 500 institutions that utilize Blackboard Transact and of those, about 100 use BbOne, says Tiede.

BbOne has multiple accounts in five areas. Overlapping areas include Andover, Mass. (Phillips Andover and Merrimack College), Fairfield, Conn. (Fairfield University and Sacred Heart University), Atlanta, Ga. (Clark Atlanta University, Georgia Tech, and Georgia State University), Claremont Calif. (Claremont Consortium), and Greensboro, N.C. (High Point U and Guilford College), says Tiede.

Campus card providers agree that the number of colleges offering off-campus capabilities will continue to grow as will the number of merchants seeking access to the college crowd. “If I’m going to open a restaurant, one thing I’ve learned: open it next to a college,” McCarthy says.

In the last five years, the University of Arizona has transformed its CatCard from a basic identification card to a multipurpose tool. In terms of security, the school has been particularly aggressive creating multiple levels of access using magnetic stripe, contactless smart card and biometric technologies.

In 1998, the Tucson, Ariz.-based university had 14 different ID cards on campus, according to Assistant Director of CatCard Services, Diane Tatterfield. University leadership decided to consolidate these into one identification card, the CatCard. Today there are 75,000 active CatCards used to gain access to 800 locations around campus.

Prior to 2006, the CatCard featured a magnetic stripe and a contact smart card chip. The mag stripe enabled physical access to buildings and privileges such as meal plans. Users loaded money onto the contact chip to pay for other services such as vending, laundry and photocopying.

The university decided to pilot a contactless chip card five-years ago when it built the BIO5 Institute and medical research laboratory buildings, Tatterfield says. Because parts of these labs demanded high security, the university needed a solution beyond what CatCard’s magnetic stripe could provide.

Partnering with Irish smart card integrator, SmartCentric, the university developed a system of three readers that enabled different levels of access based on a particular environment’s security requirements. Options include tapping the contactless chip, tapping the chip and entering a PIN, and finally tapping the chip and presenting a fingerprint for biometric matching.

Tatterfield says the university evaluated door access readers for six-months before selecting units from Integrated Engineering, a Dutch company that was acquired by HID Global in 2007. The CatCard includes an NXP DESFire contactless chip. It stores a biometric template containing a series of points from the fingerprint. This stored template is later matched with a template created by a reader at the door.

By installing the new security infrastructure at the time of construction, the university avoided a future retrofit of the buildings. With higher levels of access control, the labs have a leg up when competing for grants and contracts that require secure facilities, says Tatterfield.

While most access points on campus still use the magnetic stripe, a campuswide conversion to contactless physical access control is underway. All new construction includes contactless readers, including two new residence halls that opened this Spring with contactless tap and tap-plus-PIN security.

The University of Arizona selected door access readers from Integrated Engineering, a Dutch company that was acquired by HID Global in 2007.

The University of Arizona selected door access readers from Integrated Engineering, a Dutch company that was acquired by HID Global in 2007.

Higher levels of security do come at a price. According to Tatterfield, standalone contactless smart card readers costs the university just $40, but adding PIN capabilities ups the cost to $700 and biometric versions cost $1,200.

The total cost for a finished card–including card stock, ribbon, printer and personnel–is $42, explains Tatterfield. Students pay $25 for the card, and employees, retirees and alumni receive their first card for free. Vendors–such as Coca-Cola, Federal Express and lab supply companies–who need access to secured areas pay full price for their cards. The CatCard office receives additional funding to cover the full cost of the cards.

The university eliminated the contact chip from the card in November 2010. According to Tatterfield, improvements in technology enabled the unattended payment environments such as vending, laundry, and photocopy to move to the contactless interface. Removing the contact chip saves approximately $5 per card.

Contactless technology has helped the university save in card replacement costs. Because the magnetic stripe is swiped less frequently due to the contactless interface, the stripes do not wear out as quickly so cards don’t need to be replaced as often. This has decreased Arizona’s card replacement levels from 11,000 per year to 6,000 per year, says Tatterfield.

The university phased-in the contactless technology as new students required their initial card and returning students replaced lost cards. Today 95% of the cardholders have contactless IDs.

To leverage the CatCard’s security features, general building access is determined by the cardholder’s status. When a student signs up for a CatCard, says Tatterfield, within 15 minutes he receives access to certain facilities including computer labs, TV lounges, the recreation center, library and athletic facilities.

For more fine-grained control, the building manager for each facility can dictate access for cardholders. Access can be limited to a specific time period, such as 24/7 access, business hour access or access for a certain number of days.

The card has a lifespan of four to five years. When a card is replaced, the cardholder receives a new 16-digit ID number based on the International Organization for Standards’ ISO numbering protocol. The system automatically replaces the user’s old ISO number so that the new card is usable immediately at all access points to which the cardholder is approved.

Implementing a new system, especially a sensitive one like biometrics, took some trial and error. Relying solely on fingerprint scans for individuals who work a lot with chemicals can be difficult because chemicals can ruin people’s fingerprints. The university also discovered that it was difficult to get high quality fingerprints from Asians, explained Tatterfield.

The CatCard department worked with the university disabilities office to determine that the inability to offer a good fingerprint was, in fact, a disability. With this decision, a number of labs were downgraded from biometric readers to chip-plus-PIN security. A policy was made that if every individual using a specific lab could not use the biometrics, that lab could not upgrade the system to biometric readers.

The CatCard office also discovered that the dry Arizona climate interfered with the biometric readers. Electric shocks were frequent when users touched a reader causing interruption in the reader’s operation. To eliminate the problem, the readers were reprogrammed to reset every second instead of every five minutes. The desert heat also often made a user’s hands too dry to roll a proper print, but they found that hand lotion solves this problem.

The CatCard provides other services beyond identification and physical security. It is necessary to access e-mail accounts and class schedules. The CatCard also controls meal plans, manages Bursar accounts and authorizes library and recreation center services.

The contactless chip also contains a wallet that holds up to $250 for use on campus. Also on the financial side, a partnership with Wells Fargo enables users to tie their bank account to the CatCard and use it for debit card and ATM functions.

The contactless chip enables the university to explore non-traditional partnerships, concludes Tatterfield. Ongoing discussions with Tucson’s bus system could one day result in the CatCard being used for transit ticketing and fare collection. And a host of other applications are on the horizon as the CatCard continues to claw its way into the future.

A word to describe the state of campus banking relationships in 2010 is stagnation. According to CR80News’ latest survey of financial institutions, the number of campus card and bank partnerships remained virtually unchanged from 2009 to 2010.

Overall growth in 2010 was less than five percent, by far the smallest increase since 2003 when CR80News first surveyed the financial institutions that actively work with higher education to offer banking services as a part of the campus card program (note: only relationships that integrate the official university-issued ID card as a banking card are considered for the survey).

From that first survey, five institutions have been active providers of these services via campus cards. PNC Bank, TCF Bank, U.S. Bank, Wachovia and Wells Fargo account for more than 80% of the partnerships identified. The acquisition of Wachovia by Wells Fargo completed last year, reducing the “Big 5” to the “Big 4.” It also firmly cemented U.S. Bank and Wells Fargo as the top two players in the campus card/banking market with nearly 65% of relationships in their control.

| Bank | ‘09 total | ‘10 total | % change |

|---|---|---|---|

| Commerce | 4 | 3 | -25% |

| Heartland/CNB | 17 | 22 | 29% |

| PNC Bank | 15 | 17 | 13% |

| SunTrust | 3 | 3 | 0% |

| TCF Bank | 8 | 6 | -25% |

| U.S. Bank | 46 | 47 | 2% |

| Wells Fargo | 42 | 43 | 2% |

| Total | 135 | 141 | 4% |

But despite the Wells Fargo and Wachovia combo, U.S. Bank managed to hold onto a slim lead in total number of partnerships.

The tandem of Heartland Campus Solutions and Central National Bank & Trust (CNB) almost doubled the number of relationships jumping 89% from nine to 17 in 2009. In 2010, it maintained healthy growth, adding five more client institutions for a 29% increase.

Both U.S. Bank and Wells Fargo added one additional number to their total. Wells Fargo kept all its campus clients from the 2009 survey while adding just one, while U.S. Bank lost five prior clients but added six to its roster.

Both U.S. Bank and Wells Fargo added one additional number to their total. Wells Fargo kept all its campus clients from the 2009 survey while adding just one, while U.S. Bank lost five prior clients but added six to its roster.

The aggregate number of schools served among the seven banks surveyed jumped just seven or 5% in 2010. That compares to a year over year increases of nearly 20% in both 2008 and 2009.

This is the second year that TCF’s numbers dropped. In 2009, the bank fell from 11 to eight campus clients, and in 2010 the bank lost another two clients leaving it with six. One of the clients, Northern Michigan University, left TCF for a partnership with Wells Fargo.

Commerce Bank lost one school, falling from four to three when Wichita State opted to discontinue the banking option on its campus card.

PNC’s acquisition and integration of National City Bank in 2008 hasn’t yet been felt but the purchase did enable “us to nearly double our retail presence across 15 states and create new opportunities to grow university banking at PNC,” says Nickolas Certo, PNC’s senior vice president, university banking.

Wells Fargo’s banking footprint still covers 39 states while U.S. Bank serves campus card clients in 25 states, one more with the addition of New Mexico. TCF, PNC, Commerce and SunTrust have far smaller footprints ranging from five to eight states. The relevance is that banks can only offer campus card partnerships in those states in which they have a retail bank presence.

Was it the economy?

The economy might have had an effect on the slow growth rate in 2010, but new bank regulations likely had an even greater impact.

Don Becker, Commerce Bank assistant vice president, student banking & university cards, believes “regulatory threats are a much greater concern when exploring these partnerships. I think regulatory changes are the greatest threat to on-campus banking partnerships,” he adds.

The impact of these new regulations “is likely to be entirely negative and many banks’ debit card income could be eliminated,” says Becker.

Whitney Bright, vice president, general manager, U.S. Bank, agrees that regulatory reform is affecting campus/bank relationships. “Like other banks, we are in the process of assessing the impact of recent regulatory shifts. We believe that there are likely to be changes in how banks approach campus banking partnerships,” she says.

Fred Emery, vice president and general manager, Heartland Campus Solutions, believes that because of the publicity about credit card reform and the fees some banks charge, “this concern has caused some campuses to move slower before adding a banking relationship to their card program.”

One bank sees the new regulations as an opportunity. “It has been a difficult environment for several years, but now schools are facing an almost unprecedented economic challenge,” says PNC’s Certo. “In many ways, this has made more schools than ever open to introducing a university banking program on their campus.”

New campuses in 2010 italicized.

Commerce (3)

Fort Hays State University, KS

Pittsburg State University, KS

The University of Kansas, KS

Heartland/CNB (22)

Bastyr University, WA

Clearwater Christian College, FL

College of the Holy Cross, MA

Colorado Christian University, CO

Concordia University of Wisconsin, WI

Harrisburg University, PA

Hillsborough Community College, FL

Florida Coastal School of Law, FL

John Carroll University, OH

Lebanon Valley College, PA

Manhattan College, NY

Mississippi Delta Community College, MS

Mount Holyoke College, MA

North Central Missouri College, MO

Northwest Florida State College, FL

Palm Beach Atlantic University, FL

Pittsburgh Technical Institute, PA

Reinhardt College, GA

Slippery Rock University, PA

Tompkins Cortland Community College, NY

University of Massachusetts Lowell, MA

Waukesha County Technical College, WI

PNC Bank (17)

Allegheny College, PA

Arcadia University, PA

Carnegie Mellon University, PA

DePaul University, IL

Duquesne University, PA

Edinboro University of Pennsylvania, PA

Grove City College, PA

Indiana University of Pennsylvania, PA

Marymount University, VA

Mercyhurst College, PA

Mount St. Mary’s University, MD

Penn State University–18 campuses, PA

St. Joseph’s University, PA

University of Cincinnati, OH

University of Delaware, DE

University of Pennsylvania, PA

University of Pittsburgh, PA

SunTrust (3)

Florida State University, FL

Mary Baldwin College, VA

University of Central Florida, FL

TCF Bank (6)

Eastern Michigan University, MI

Northern Illinois University, IL

St. Cloud State University, MN

University of Illinois, IL

University of Michigan, MI

University of Minnesota, MN

U.S. Bank (47)

Austin Peay State University, TN

Benedictine University, IL

California State University–Fullerton, CA

California State University–San Bernardino, CA

Capital University, OH

Carroll University, WI

Case Western Reserve University, OH

Central Washington University, WA

College of Mt. St. Joseph, OH

Colorado State University–Pueblo, CO

Concordia University Chicago, IL

Creighton University, NE

Drury University, MO

Gonzaga University, WA

Henderson State University, AR

Iowa State University, IA

John Carroll University, OH

Johnson County Community College, KS

Kirkwood Community College, IA

Metropolitan State College of Denver, CO

Milwaukee Area Technical College, WI

Minnesota State University–Moorhead, MN

Missouri Baptist University, MO

Missouri Western State University, MO

Morehead State University, KY

North Dakota State University, ND

Northern Kentucky University, KY

Northwest Missouri State University, MO

Northwestern University, WI

Pacific University, OR

Saint Louis University, MO

San Diego State University, CA

San Jose State University, CA

Seattle University, WA

Southwest Minnesota State University, MN

St. Cloud Technical College, MN

Thomas More College, KY

Truman State University, MO

University of California Davis, CA

University of Central Missouri, MO

University of San Diego, CA

University of Wisconsin–Eau Claire, WI

University of Wisconsin–Stevens Point, WI

Washington State University, WA

Waukesha County Technical College, WI

Wisconsin Lutheran College, WI

Xavier University, OH

Wells Fargo (43)

Baylor University TX

California State University–East Bay, CA

California State University–Los Angeles, CA

California State University–Sacramento, CA

California State University–San Francisco, CA

California State University–Stanislaus, CA

Clark Atlanta University, GA

El Paso Community College, TX

Elon University, NC

Fayetteville State University, NC

Florida A&M University, FL

Front Range Community College, CO

Georgia Perimeter College, GA

Guilford College, NC

Mercer University, GA

Mesa State College, CO

Midwestern State University, TX

Minnesota State University–Mankato, MN

New Mexico State University, NM

North Carolina State University, NC

North Carolina A&T State University, NC

North Carolina Central University, NC

Northern Michigan University, MI

Riverside Community College District, CA

Texas A&M University–College Station, TX

Texas A&M University–Corpus Christie, TX

Texas State University–San Marcos, TX

University of Arizona, AZ

University of Florida, FL

University of Nebraska–Kearney, NE

University of Nebraska–Lincoln, NE

University of Nevada–Las Vegas, NV

University of Nevada–Reno, NV

University of N.C.–Chapel Hill, NC

University of N.C.–Greensboro, NC

University of North Texas, TX

University of Northern Colorado, CO

University of Texas–Arlington, TX

University of Texas–Brownsville, TX

University of Texas–Dallas, TX

University of Texas–El Paso, TX

Villanova University, VA

Virginia Commonwealth University, TX

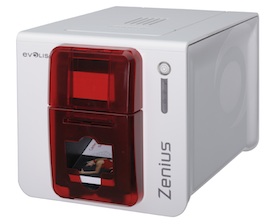

Evolis announced the launch of ZENIUS, its next-generation card printer that is focused on the user. With the new card printer, Evolis offers a single-sided color printer that is compact, modular and designed to be easy-to-use.

Evolis announced the launch of ZENIUS, its next-generation card printer that is focused on the user. With the new card printer, Evolis offers a single-sided color printer that is compact, modular and designed to be easy-to-use.

With ZENIUS, Evolis has redesigned its printing engine and overall environment with a new design, software architecture and enhanced consumables. With these additions, printing cards and badges is designed to be simple to serve a variety of applications: employee IDs, loyalty cards, student IDs, payment cards, transportation passes, and more.

The new Evolis Premium Suite software architecture includes a configuration and printing manager that aims to improve communication between the printer and the user.

The printer can be monitored directly from the user’s interface through pop-up notifications that provide information on the printer’s status.

The Evolis High Trust range of consumables has been designed to enhance graphic performances and simplify routine tasks. For easy handling, the new ribbons are supplied in a cassette that houses an RFID chip. This helps the printer identify the ribbon type and configure all settings accordingly.

The new printer is also designed to be compact and quiet so it can fit at a welcome desk, a sales counter, or an office desk.

ZENIUS is an eco-designed printer that uses recycled material that can be recycled. The printer also is a low-energy system as it complies with the stringent ErP European directive.

ZENIUS is now available in its Classic version. An Expert version will be available end of 2011, offering the capacity to combine multiple encoders within a single system. This array of encoding options will allow the personalization of technology cards, from tamper proof access control badges to payment cards.

So you’re a two-year institution looking to take it to the next level, eh? Your students demand the same services offered at a larger four year-year university and administrators are determined to enhance operational efficiencies. But, a shrinking budget says otherwise.

Well don’t worry because the CBORD Group is hosting a webinar series discussing just that. The series will run from June to October and will focus on issues facing two-year colleges, including:

Georgia Perimeter College, located in suburban Atlanta, first started its one-card program on just one of its six campuses more than ten years ago. The college has since produced more than 185,000 ID cards and has seen a 375 percent sales increase at the college’s bookstores.

Georgia Perimeter College’s JCard Office now supports six bookstores, five food service locations, five ID offices, has nearly 250 point-of-sale card readers, more than 350 access card readers, and over 1,800 security alarms.

Learn how Georgia Perimeter College has met these challenges in the first of a four-part webinar series for two-year institutions on June 16 at 2 p.m. (EST).

Join CBORD and representatives of Georgia Perimeter College’s JCard Office for this webinar by registering on the CBORD Web site at http://universities.cbord.com/online/.

Systems catching on from Fortune 500s to Major League Baseball

Systems catching on from Fortune 500s to Major League Baseball

Security checks have become a fact of life for entrance to public buildings. As government agencies, corporations and schools struggle to keep track of individuals within their facilities at any point in time, a new breed of visitor management systems has risen to the top.

Though it may be more apparent today, visitor management is not a new function. For as long as organizations have sought to control access to facilities, there has been a need to manage visitors, vendors and other non-recurring guests. In the past, paper-based logs were managed by lobby attendants to ensure visitors had a legitimate reason to enter. Today’s electronic solutions automate these functions adding convenience and robust new security features to the process.

There are a number of different visitor management solutions on the market. Some are available as a part of enterprise-level solutions while others are off-the-shelf software products. Regardless of the solution, it should enable better control over access to facilities and automate the visitor entry and exit process. Upon check-in, a badge should be printed on-the-spot for use by the visitor. And after the fact, the electronic visitor logs should be able to be queried for reporting purposes.

The products can improve the first impression a visitor forms of the organization as well as improve both employee and visitors safety.

When evaluating visitor management solutions, there are many features to consider including ability to:

Baseball teams take a cut at visitor management

Two U.S. professional baseball teams–the Seattle Mariners and the Cleveland Indians–were trying to get a better handle on the people entering their facilities. “We wanted a more professional appearance at the front desk so we could track who’s coming in,” explains David R. Powell, senior director of information systems for the Cleveland Indians.

“We wanted to move away from handwritten ID stickers,” he says. “We were looking for a canned package.”

In addition to visitor tracking, the Indians also wanted to use the system with internal staff. “We needed a system to produce employee IDs because the one we were using in-house was developed some ten-years earlier and it was just too cumbersome,” explains Powell.

But the most important reason for the solution was the Indians’ need to track the vendors who visited the ball club often on a daily basis. They wanted to automate the paper-based sign in process being used to keep track of vendors.

With an electronic version, the Indians could easily check to see when a specific vendor–an electrician, for example–was last in. But more importantly, it enabled system operators to store individual records in a database and easily replicate a new badge the next time the vendor arrived.

“We have a lot of visitors and on any given day maybe 20 outside contractors. So we needed something to keep track of who was in the building at any one time,” Powell says. “In a two-week period we have about 300 visitor entries.”

The Indians chose Lobby Track, a visitor management solution from San Carlos, Calif.-based Jolly Technologies. “We found Jolly and we liked what we saw,” says Powell.

Named after its founder and CEO, Sandeep Jolly, the company got its start a decade ago producing bar code label products. In 2003 Jolly released its Print Studio solution to produce bar code labels, but the program also gained acceptance in the ID card market due to those same bar code capabilities. This led them to develop ID Flow and Lobby Track, the company’s people-tracking solution, in 2008.

Jolly’s biggest customers can be found in the defense industry, pharmaceuticals, oil and gas, retail, and now even baseball teams, says Kurt Bell, Jolly’s vice president of sales and marketing. The company is also seeing a need for its technology in other areas, including schools and college campuses.

For the Seattle Mariners, Lobby Track was the next logical step to secure its facilities. “We were already using ID Flow, Jolly’s badge-making program,” says Erik Hackmann, security supervisor for the Mariners. “We wanted something that would integrate with it.”

He explains that they wanted to use the badging database as part of the company’s host lookup. “When a visitor comes in he has to have a host, someone in the organization that is their sponsor. We have a database of people who are authorized to be hosts,” says Hackmann.

“You can look up the host and when an expected visitor arrives it can send an email that the visitor is here,” explains Bell.

Like the Indians, the Mariners consider everybody that’s not an employee to be a visitor. “The Mariners did 8,000 visitors last year,” Hackmann says.

“Right now, we’re in the off season so most are contractors who are doing all of our projects. We’re remodeling parts of the ballpark and everyone has to have a badge. We’re averaging between 40-50 a day,” says Hackmann.

Robust features take visitor management systems beyond badging solutions

Lobby Track has the ability to check visitors against terrorist watch lists and, particularly important for schools, sexual offender databases, Bell says.

Many organizations choose to produce guest badges using light-sensitive paper that darkens over time due to the chemical reaction produced by the thermal printing process used to produce the badges. This enables badges more than a day old to be visibly identified if they are reused for entry to facilities.

Most solutions enable both paper badges and plastic IDs to be produced. “If you’re going to be in seven times a year or more, we’ll issue a plastic badge, (but) temporary visitors get a paper badge,” says Powell.

Lobby Track automates data entry by scanning a guest’s driver license or business card. Information can be entered manually, if need be, and a Web cam is used to take a photo. “In most cases I take a new photo of everyone rather than use the driver license photo,” says Powell.

“We recently upgraded to the Enterprise version so we can run it here in Cleveland as well as at our spring training facility in Goodyear, Ariz.,” says Powell. Lobby Track’s Enterprise version is “faster and better suited to working in multiple locations,” he adds.

Adding applications and markets

Because of its tracking ability, Jolly’s software is useable in other venues, such as event tracking, lab access or even school attendance, says Bell.

While visitor management could work with universities, it’s not an easy market to crack. “The university market has been very difficult for visitor management, primarily because campuses are wide open,” says Bell. “To do it effectively you need to have a single entrance point, and students would have to have a noticeable ID in plain sight.”

But the K-12 market is different. “It’s more widely used,” says Bell. “Campuses aren’t as big and you have to get your badge at the office before proceeding on campus.” And it’s easy to distinguish adults from students, which is why K-12 students don’t need a visible badge.

Tracking software like Jolly’s is pretty much a behind-the-scenes product that, if it does its job, no one knows it’s even there. As the Indians’ Powell put it: “Visitor management isn’t the most high profile thing out there. It simply works so we can worry about the things that are more important.”

Heartland Payment Systems’ Campus Solutions, in partnership with Bridgeway Solutions, has been chosen as one of South Carolina’s preferred system providers for integrated ID solutions and local support.

This arrangement with South Carolina will enable the state’s agencies and public colleges and universities to purchase Heartland Campus Solutions and Bridgeway Solution’s services without having to issue a request for proposal as is traditionally required by the state.

This relationship between Bridgeway, Heartland and the State of South Carolina provides ID production, identity management and campus card use while offering desired local support to the campus communities. The Heartland Campus OneCard System offers solutions for various areas of campus including access and security, vending, dining, copy and print management, bookstore financials, Web and mobile use, activity and event management as well as banking and financial aid disbursement.

This solution, paired with Bridgeway Solutions, enables campuses to enhance student services while providing a higher level of efficiency.